Binghatti IPO: What Dubai Investors Need to Know About This Market Move

Binghatti’s IPO talks signal a pivotal moment for Dubai’s luxury real estate investment landscape.

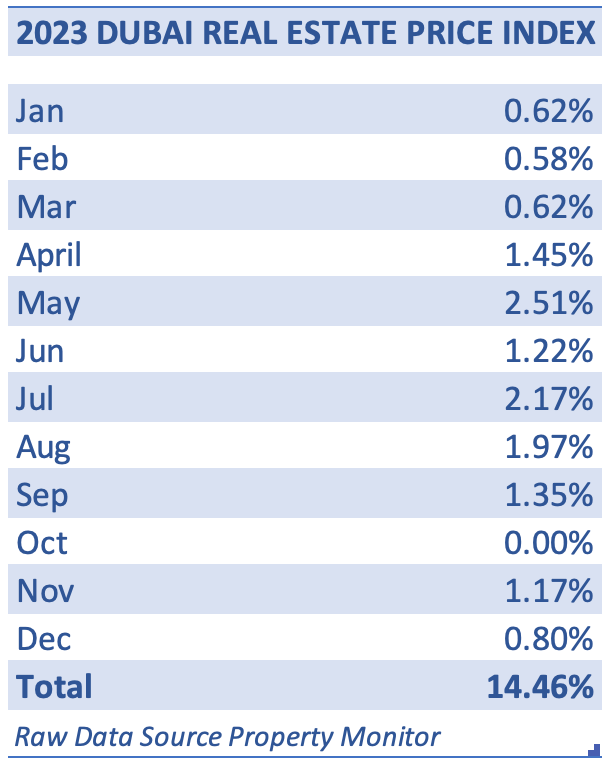

1. Market context and IPO significance

Dubai’s real estate market continues to demonstrate resilience and robust growth despite regional geopolitical uncertainties and global economic challenges. The discussions between Binghatti Holding and major financial institutions such as Citi and Morgan Stanley about a potential initial public offering (IPO) underscore the developer’s ambition to capitalize on this momentum. For investors focused on Dubai real estate, this move reflects confidence in the emirate’s property sector and may influence market dynamics, particularly in luxury homes Dubai.

2. Implications for investors in Dubai real estate

Binghatti’s IPO plans come at a time when Dubai’s housing market is experiencing a surge in demand, driven by both end-users and investors. The developer’s strong financial performance, with profits more than doubling in recent periods, highlights the profitability potential within the Dubai property for sale segment. Investors should note that the IPO could enhance market transparency and provide new opportunities for portfolio diversification through exposure to a leading developer’s assets.

3. Strategic positioning and luxury market impact

While Binghatti maintains a significant presence in mid-market housing, its strategic push into luxury projects, including high-profile branded towers and record-breaking residential buildings, aligns with Dubai’s growing appeal as a global luxury property hub. This dual focus offers investors access to a broad spectrum of real estate products, from affordable luxury to ultra-premium developments, positioning Binghatti as a key player in shaping the future of luxury homes Dubai.

4. Market risks and investor considerations

Despite the optimistic outlook, analysts caution about potential market corrections due to an influx of new housing supply anticipated by 2026. Investors should weigh these risks alongside the opportunity presented by Binghatti’s IPO and the broader Dubai market. Understanding the balance between supply growth and demand sustainability is crucial for making informed decisions in Dubai real estate investment.

5. Broader sector trends and fundraising activities

Binghatti’s IPO is part of a wider trend among Dubai developers leveraging capital markets to fund expansion and innovation. The company’s recent initiatives, including launching an asset management arm and raising significant funds through sukuk offerings, demonstrate a sophisticated approach to real estate finance Dubai. These developments suggest a maturing market where institutional investors and family offices increasingly participate, enhancing liquidity and market depth.

6. What this means for Dubai property buyers and investors

For buyers and investors looking to buy luxury property in Dubai, Binghatti’s potential public listing may introduce new investment vehicles and increase confidence in the sector’s long-term growth. The IPO could also stimulate competition among developers, potentially leading to more innovative projects and improved market offerings. Staying informed about such market movements is essential for capitalizing on Dubai’s evolving real estate landscape.

Let’s Connect.

Whether you’re in the market to purchase or sell your property, we assure you that our knowledge, professionalism and unwavering commitment will help you fulfill your individual real estate requirements.

HELLO@BONDPROPERTIESGLOBAL.COM

Source: Original article (10.03.2025)